The banking industry is a complex and dynamic Sector that performs a vital role in the global economy. Banks provide a wide variety of economic services to individuals, organizations, and governments, inclusive of deposit money owed, loans, bills, and investment merchandise. The industry is tremendously regulated and problem to a spread of risks, inclusive of credit score danger, marketplace threat, and operational hazard.

The banking enterprise is present process a rapid transformation, pushed through technological improvements and evolving client expectancies. To live beforehand of the curve, banks need to embrace progressive solutions that decorate their efficiency, protection, and consumer enjoy.

We have a proven track record of developing and implementing innovative software solutions for banking clients. Our deep understanding of the banking industry and our expertise in various technologies enable us to provide customized solutions that address specific business challenges

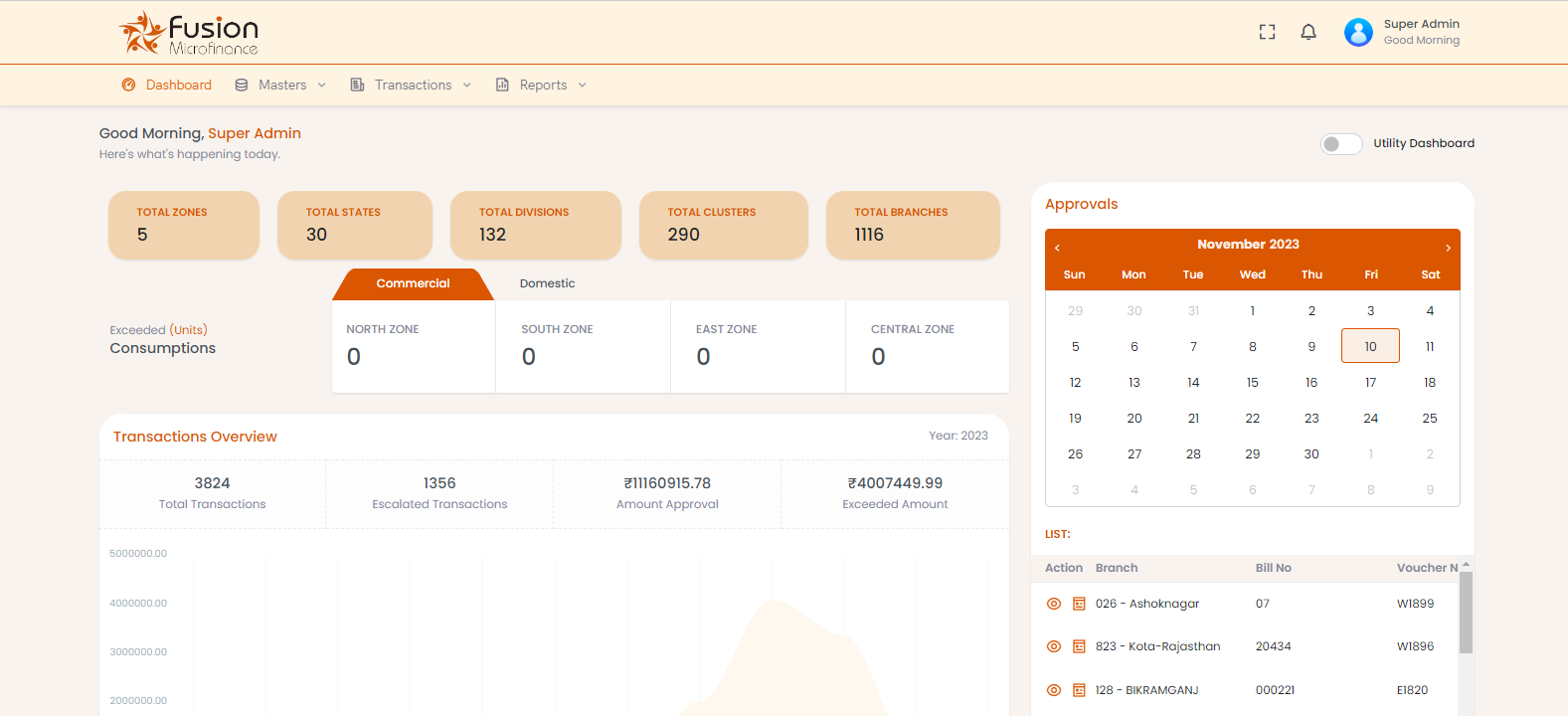

We evolved an e-Learning platform for Fusion Micro Finance, a leading microfinance Bank in India. The platform presents complete education materials for team of workers individuals, permitting them to decorate their abilities and understanding in microfinance operations.

We are committed to providing our banking clients with cutting-edge software solutions that empower them to meet their business goals, enhance customer satisfaction, and thrive in the ever-evolving financial landscape.

Generation has revolutionized the banking enterprise, supplying banks with a wide range of solutions to enhance efficiency, beautify consumer revel in, and advantage a aggressive part. right here are a number of the key technology solutions for the banking enterprise: